Financial illiteracy remains a pervasive issue, impacting individuals’ ability to manage their finances effectively. This article delves into the definition and impact of financial illiteracy, highlighting common signs and the crucial role education plays in addressing this challenge. We explore how productivity software can serve as a powerful tool to enhance financial literacy, featuring expert insights and real-world success stories. Despite the benefits, implementing these solutions comes with challenges. We provide recommendations for choosing the right productivity software and look ahead to future trends in technology that promise to further improve financial literacy.

zokablog.com will take you through an extensive exploration of this topic.

1. Definition and impact of financial illiteracy.

Financial illiteracy refers to the lack of knowledge and skills necessary to make informed and effective decisions regarding personal financial management. This deficit can manifest in various ways, including a poor understanding of budgeting, saving, investing, and debt management. Individuals who are financially illiterate often struggle with basic financial concepts, which can lead to detrimental financial behaviors and decisions.

The impact of financial illiteracy is far-reaching. On an individual level, it can result in increased debt, insufficient savings, and a lack of preparedness for emergencies or retirement. Financially illiterate individuals are more likely to incur high-interest loans, fall into debt traps, and experience significant stress related to their financial situation. This stress can affect mental health, relationships, and overall well-being.

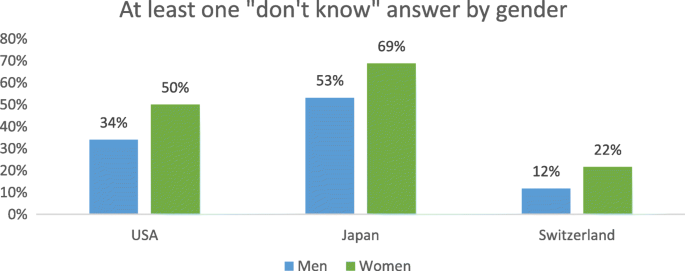

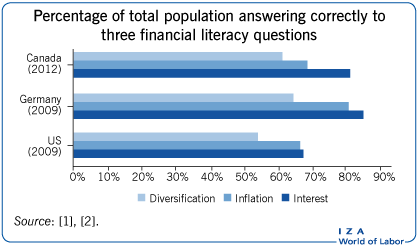

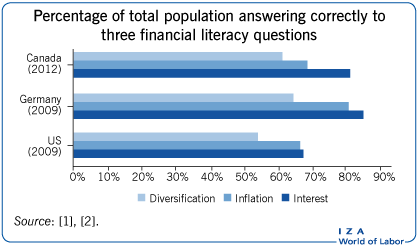

On a broader scale, financial illiteracy can have serious economic implications. A population with low financial literacy contributes to a less stable economy, as individuals are less likely to engage in healthy financial practices, such as saving for retirement or investing in the stock market. This can lead to decreased consumer spending and lower economic growth. Additionally, financially illiterate individuals are more susceptible to fraud and predatory financial practices, which can further exacerbate economic inequality.

Addressing financial illiteracy through education and practical tools is essential for fostering a financially healthy and resilient society.

2. Common signs of financial illiteracy in individuals.

Common signs of financial illiteracy in individuals include a lack of basic financial knowledge and difficulty managing personal finances effectively. One prominent sign is the inability to create and stick to a budget, leading to overspending and frequent financial shortfalls. Financially illiterate individuals often struggle with understanding interest rates, resulting in the accumulation of high-interest debt and difficulty managing credit cards responsibly.

Another indicator is a lack of savings for emergencies or future needs, such as retirement. These individuals may also demonstrate poor investment decisions, showing little understanding of risk diversification or the benefits of long-term investing. Difficulty distinguishing between wants and needs often leads to impulsive spending and inadequate financial planning.

Financial illiteracy can also manifest as a reliance on high-cost borrowing options, such as payday loans, due to a lack of knowledge about more affordable credit alternatives. Additionally, financially illiterate individuals are more prone to falling for financial scams and fraud, as they may not recognize warning signs of deceptive practices. Identifying these signs can help in targeting educational efforts to improve financial lit

3. Role of education in addressing financial illiteracy.

Education plays a pivotal role in addressing financial illiteracy by equipping individuals with the knowledge and skills necessary to make informed financial decisions. Integrating financial education into school curricula ensures that young people develop a strong foundation in financial concepts early on. This early education can include lessons on budgeting, saving, investing, and understanding credit, which are essential for fostering long-term financial health.

Beyond formal education, community-based programs and workshops can offer practical financial education to adults. These programs can address specific needs, such as debt management, retirement planning, and investing, tailored to different life stages and financial situations. Financial literacy campaigns, often spearheaded by governments and non-profit organizations, also play a crucial role in raising awareness and providing resources.

Moreover, access to online courses and resources has made financial education more accessible than ever. By promoting continuous learning and practical application, education empowers individuals to take control of their finances, make informed decisions, and i

4. Introduction to productivity software as a solution.

Productivity software has emerged as a powerful solution to combat financial illiteracy, offering a range of tools that help individuals manage their finances more effectively. These software applications are designed to streamline financial tasks, providing users with easy-to-use interfaces and comprehensive features that simplify complex financial processes. From budgeting apps to investment tracking tools, productivity software makes financial management more accessible and less intimidating.

One of the primary advantages of productivity software is its ability to provide real-time insights into financial health. Users can track their spending, monitor their savings goals, and receive alerts for bill payments, helping them stay on top of their finances. Additionally, many of these tools offer educational resources, such as tutorials and financial tips, which further enhance users’ financial literacy.

By integrating these tools into their daily routines, individuals can develop better financial habits and gain a clearer understanding of their financial situation. Productivity software also often includes features that automate routine tasks, reducing the likelihood of errors and freeing up time for users to focus on other aspects of their financial planning. In essence, productivity software serves as both a practical aid and an educational resource, empowering users to take control of their financial futures.

5. Features of productivity software that aid financial literacy.

Productivity software offers a variety of features that significantly aid financial literacy and management. One key feature is budgeting tools, which allow users to create and track budgets in real-time. These tools help individuals categorize their expenses, set spending limits, and visualize their financial habits, promoting better money management.

Another important feature is automated bill reminders, which ensure that users never miss a payment, thereby avoiding late fees and maintaining good credit scores. Savings goal trackers are also common, enabling users to set and monitor their progress toward specific financial objectives, such as building an emergency fund or saving for a major purchase.

Investment tracking is another crucial feature, providing users with insights into their investment portfolios and helping them understand market trends and the performance of their assets. Educational resources, including tutorials, financial tips, and interactive learning modules, are often integrated into these tools, enhancing users’ financial knowledge.

Additionally, many productivity software applications offer secure data encryption, ensuring that users’ financial information is protected. These features collectively empower individuals to make informed f

6. Expert opinions on the effectiveness of these tools.

Experts generally view productivity software as an effective tool in enhancing financial literacy and management. Financial advisors often highlight the value of these tools in simplifying complex financial tasks and providing clear insights into personal finances. According to financial experts, budgeting apps and expense trackers can help individuals develop and maintain better financial habits by offering a clear view of their spending patterns and helping them stick to their budgets.

Investment professionals also praise these tools for their ability to offer real-time data and analytics, which are crucial for making informed investment decisions. By providing users with performance metrics and market trends, investment tracking features enable individuals to monitor their portfolios more effectively and adjust their strategies based on current data.

Moreover, financial educators emphasize the importance of educational resources integrated into productivity software. These resources, such as tutorials and tips, help users build their financial knowledge and make more informed decisions.

7. Real-world success stories using productivity software.

Real-world success stories illustrate the transformative impact of productivity software on financial management. One notable example is Sarah, a young professional who struggled with budgeting and managing her expenses. After adopting a popular budgeting app, Sarah was able to categorize her spending, set realistic financial goals, and track her progress. Within six months, she reduced her monthly expenses by 20% and built a substantial emergency fund, thanks to the insights and tools provided by the app.

Similarly, John, a small business owner, used financial management software to streamline his accounting processes and track his business expenses. The software’s automated invoicing and expense tracking features helped him gain a clearer understanding of his cash flow, leading to more informed financial decisions. As a result, John increased his business’s profitability and was better prepared for tax season.

These success stories highlight how productivity software can lead to significant improvements in financial management. By providing practical tools and educational resources, these applications empower users to make informed financial decisions, achieve their goals, and enhance their overall financial well-being.

8. Challenges in implementing these solutions.

Implementing productivity software for financial management can come with several challenges. One significant issue is the initial learning curve associated with new tools. Users may find it difficult to navigate and fully utilize the software’s features, particularly if they lack prior financial knowledge or experience with similar tools. This can lead to underuse or ineffective use of the software.

Another challenge is data security. While many productivity tools offer robust encryption, users must be vigilant about protecting their personal financial information. Security breaches or misuse of data can pose significant risks.

Additionally, integrating these tools with existing financial systems or accounts can sometimes be complex and may require technical support. Users may also face challenges in consistently updating and maintaining their financial data within the software, which is crucial for accurate tracking and analysis.

Finally, while productivity software offers many benefits, it cannot replace comprehensive financial education or personalized advice from financial professionals. Users may still need t

9. Recommendations for choosing the right productivity software.

When choosing the right productivity software for financial management, consider several key factors to ensure the tool meets your needs effectively. First, assess the software’s features to ensure they align with your financial goals. Look for tools that offer comprehensive budgeting, expense tracking, and investment monitoring capabilities. Features such as automated bill reminders and savings goal trackers can provide added convenience and support.

Next, evaluate the user interface and ease of use. The software should be intuitive and user-friendly, allowing you to navigate its features without extensive training. A clear, simple design can enhance your experience and encourage regular use.

Data security is another crucial consideration. Choose software that offers strong encryption and privacy protections to safeguard your financial information. Ensure that the tool complies with relevant data protection regulations and has a good reputation for security.

Check for integration options with your existing financial accounts and systems. Seamless integration can simplify data management and provide a more comprehensive view of your finances.

Lastly, consider customer support and educational resources provided by the software. Access to responsive support and helpful resources, such as tutorials and financial tips, can enh

10. Future trends in technology and financial literacy.

Future trends in technology are poised to significantly enhance financial literacy and management. One notable trend is the rise of artificial intelligence (AI) and machine learning in financial software. These technologies are expected to provide more personalized financial advice and predictive analytics, helping users make informed decisions based on their unique financial situations and goals.

Another trend is the integration of blockchain technology, which promises increased transparency and security in financial transactions. Blockchain’s decentralized nature can enhance trust and reduce fraud, offering users a more secure way to manage and track their financial activities.

Additionally, the proliferation of mobile finance apps continues to grow, making financial management more accessible. Innovations in mobile technology will likely bring advanced features, such as real-time financial alerts and seamless integration with other digital tools, to improve user experience.

Furthermore, gamification is becoming a popular approach to financial education, making learning about finance more engaging and interactive. By incorporating game-like elements

In conclusion, addressing financial illiteracy through productivity software offers a promising path to improved financial management. These tools provide essential features for budgeting, tracking expenses, and investing, supported by expert insights and real-world success stories. While challenges exist, such as the learning curve and data security, careful selection and effective use of these tools can significantly enhance financial literacy. As technology continues to evolve, integrating advancements like AI and blockchain will further empower individuals to manage their finances more effectively and build a financially secur

zokablog.com

zokablog.com